How to Permanently Close Flipkart Pay Later Service?

Learn more about your Flipkart Pay Later Financial Service Provider:

- IDFC First Bank Ltd provides Flipkart Pay Later.

- You can confirm this by reviewing your CIBIL

- You can confirm this by reviewing your CIBIL report (report number: 887).

- On your CIBIL report, you can also view a list of your loan or pay-later accounts.

- If you want to cancel your Flipkart Pay Later Account, contact Flipkart Customer Support. In this instance, contacting IDFC First Bank directly will be ineffective.

How to Permanently Close Flipkart Pay Later?

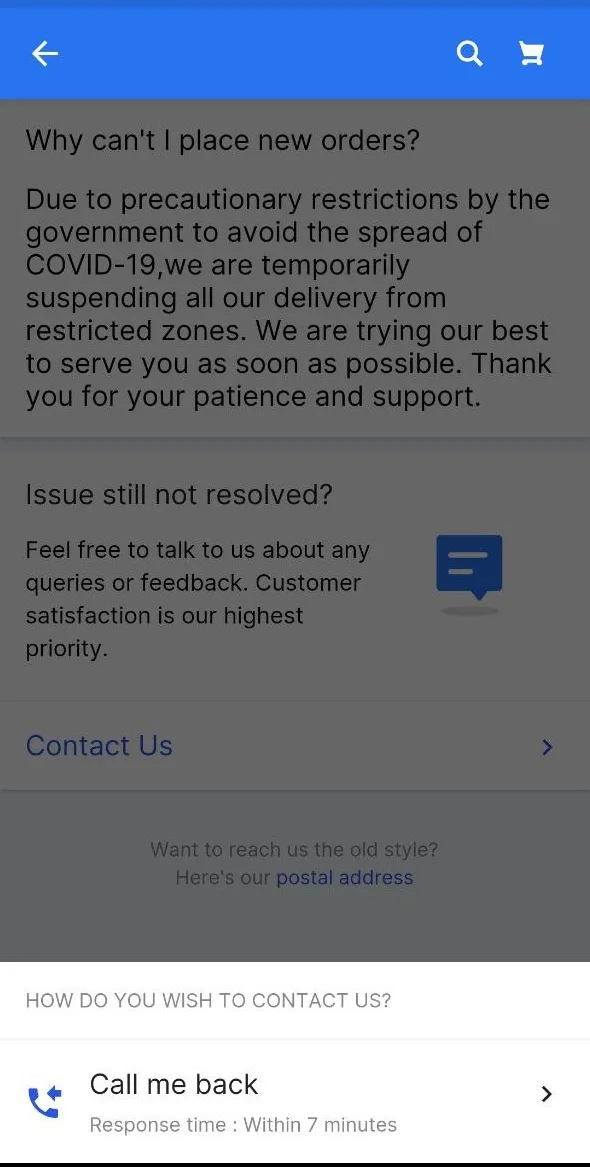

Contact Flipkart Customer Support to simply close your Flipkart Pay Later Account. Simply email them and request that the account be permanently closed.Head over to Flipkart Helpcenter

Select ‘I want help with other issues’.

Select ‘Others’ > ‘Other’.

When you go to the help website, you’ll see options like ‘Chat’ or ‘Request a Callback’.

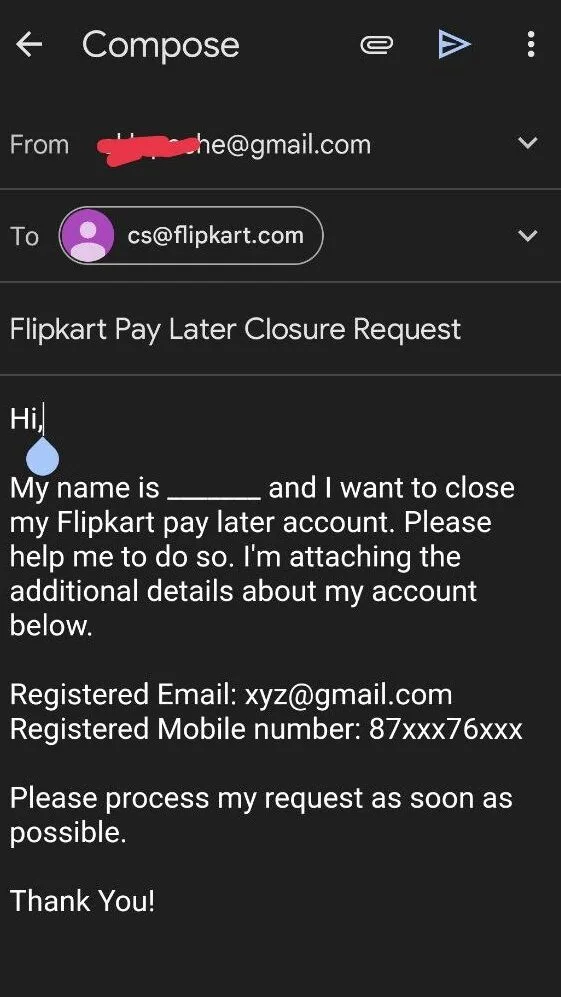

Closure Request Email:

If you’re not sure how to close your Flipkart Pay Later account, send an email to Flipkart at “Cs@flipkart.com” from your registered email address. Make sure to explicitly specify your account closure request in the email topic, such as “Flipkart Pay Later Closure Request.”

Contact the RBI Ombudsman: If your account closure request is not honored or you do not obtain NOC despite asking it, you can file a grievance with the RBI Ombudsman.

Important Things to Remember:

Before you close your Flipkart Pay Later account, do the following changes:

Check that any pending payments have been cleared; otherwise, the account will not shut.

Your lending provider should send you a No Objection Certificate (NOC) certifying the closure of your Flipkart Pay Later account with no outstanding debts. If you have not received it within 2-3 weeks of requesting account termination, please request it.

You may notice a brief fall in your credit score after cancelling your account, though this is not always the case. Don’t be concerned; this is usual.

It may take up to 2-3 months for the ‘closure’ to appear on your CIBIL profile, so don’t be alarmed if the Flipkart Pay Later Loan is still labeled as ‘active’ for a while.

Even after you close your Flipkart Pay Later account, it will remain on your CIBIL report as a ‘closed’ account for record-keeping purposes. This assists potential lenders in understanding your credit history.

If you’re new to credit and don’t yet have any credit cards, keeping your Flipkart Pay Later account active will help. It builds credit history, and the age of a credit line can have a beneficial impact on your credit score. This may make it easier for you to obtain a credit card or a loan in the future.